|

|

|

|

Dear [NAME],

We’re excited to bring you the Kotak Multicap Fund—an investment choice trusted by 7,07,329 investors^ to help them build towards their financial goals. |

|

|

Here’s why you could consider this fund |

|

|

|

|

|

Power of All in One~: The fund is a mix of large-cap, mid-cap, and small-cap stocks that work together as a team to create opportunities. |

|

|

|

|

|

Dynamic Strategy: Uses a proprietary model to adjust allocations, balancing growth potential with risk management. |

|

|

|

|

|

Performance Track Record: A monthly SIP in the fund has outperformed its benchmark by 3.83% since inception*. |

|

|

|

|

|

|

|

*Data as on Apr 30, 2025. Scheme inception date is Sep 29, 2021. Performance mentioned is of Kotak Multicap Fund (Reg Plan – Growth Option). Please refer below for complete disclosure of performance for both Regular and Direct plans. Past Performance may or may not sustain in future. |

|

|

|

|

|

We believe the Kotak Multicap Fund could complement your investment portfolio by offering a dynamic approach to equity markets.

As always, you may consult your financial expert before making an investment decision.

Warm Regards, Kotak Mutual Fund. |

|

|

|

|

|

^ Source: KMAMC Internal, Factsheet | Data as of Mar 31, 2025. |

~ Investing across large cap, mid cap & small cap stocks. As per para 2.7 of SEBI Master Circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024 Large Cap: 1st -100th company in terms of full market capitalization. Mid Cap: 101st -250th company in terms of full market capitalization. Small cap: 251st company onwards in terms of full market capitalization. |

|

|

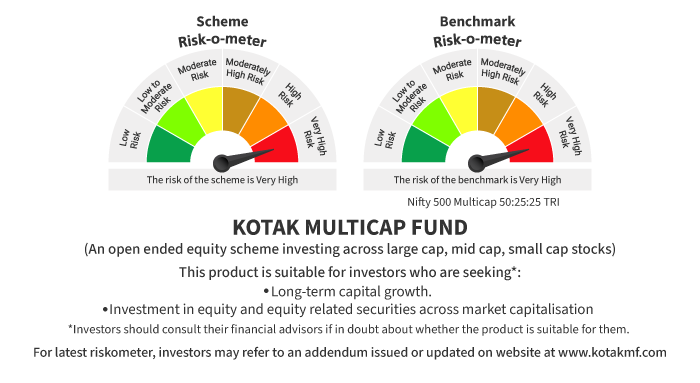

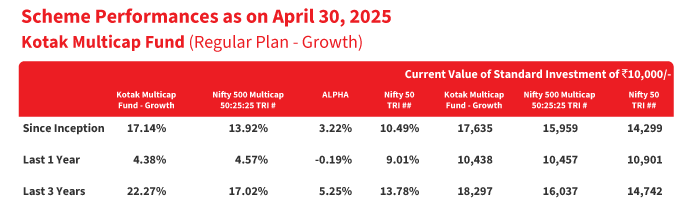

Scheme Inception: Sep 29, 2021. Mr. Devender Singhal & Mr. Abhishek Bisen has been managing the fund since Sep 29, 2021. Different plans have different expense structures. The performance details provided herein are of the Regular Plan – Growth Option. Past performance may or may not be sustained in future. All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Returns >= 1 year: CAGR (Compounded Annualised Growth Rate). N.A stands for data not available. Note: Point to Point (PTP) Returns in INR shows the value of ₹10,000/- investment made at inception. Source: ICRA MFI Explorer. # Name of Scheme Benchmark. ## Name of Additional Benchmark. TRI - Total Return Index, in terms of para 6.14 of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated Jun 27, 2024, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI). |

|

Scheme Inception: Sep 29, 2021. The returns are calculated by XIRR approach assuming investment of ₹10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and final value and a series of cash inflows and outflows and taking the time of investment into consideration. Since inception returns are assumed to be starting from the beginning of the subsequent month from the date of inception. The SIP Performance is for Regular Plan – Growth Option. Different plans have different expense structure. # Benchmark; ^ Additional Benchmark. TRI – Total Return Index, in terms of para 6.14 of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated Jun 27, 2024, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI). Alpha is difference of scheme return with benchmark return. *All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Source: ICRA MFI Explorer. |

|

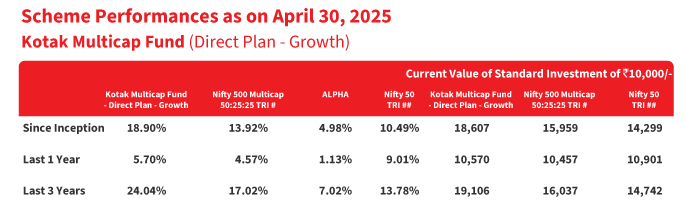

Scheme Inception: Sep 29, 2021. Mr. Devender Singhal & Mr. Abhishek Bisen has been managing the fund since Sep 29, 2021. Different plans have different expense structures. The performance details provided herein are of the Direct Plan – Growth Option. Past performance may or may not be sustained in future. All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Returns >= 1 year: CAGR (Compounded Annualised Growth Rate). N.A stands for data not available. Note: Point to Point (PTP) Returns in INR shows the value of ₹10,000/- investment made at inception. Source: ICRA MFI Explorer. # Name of Scheme Benchmark. ## Name of Additional Benchmark. TRI - Total Return Index, in terms of para 6.14 of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated Jun 27, 2024, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI). |

|

Scheme Inception: Sep 29, 2021. The returns are calculated by XIRR approach assuming investment of ₹10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and final value and a series of cash inflows and outflows and taking the time of investment into consideration. Since inception returns are assumed to be starting from the beginning of the subsequent month from the date of inception. The SIP Performance is for Direct Plan – Growth Option. Different plans have different expense structure. # Benchmark; ^ Additional Benchmark. TRI – Total Return Index, in terms of para 6.14 of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated Jun 27, 2024, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI). Alpha is difference of scheme return with benchmark return. *All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Source: ICRA MFI Explorer. |

Kotak Multi Cap Fund is managed by Mr. Devender Singhal and Mr. Abhishek Bisen. View the other funds managed by them: Regular Plan & Direct Plan |

Past performance may or may not be sustained in future. For detailed portfolio and related disclosures for the scheme please refer our website. The portfolio and its composition is subject to change and the same position may or may not be sustained in future. The fund manager may make the changes, as per different market conditions and in the best interest of the investors. To view the latest complete performance details of the Scheme kindly refer to the factsheet on our website. |

This material is not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited. Accordingly, persons who come into possession of this document are required to inform themselves about and observe any such restrictions. |

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Get in touch: Write to us | 18003091490 | Download App |

|

|

|

|

|

|